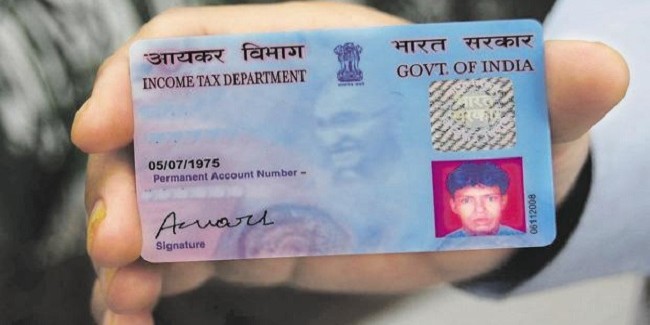

According to the income tax website, till 31 March 2018, there were about 379 million Permanent Account Numbers (PAN) allotted to various entities. Out of these, 369 million or 97.46% PANs were allotted to individuals. But irrespective of the fact that you have been allotted a PAN, it is not mandatory to file an income tax return (ITR) if your income is less than the maximum exemption limit. But it is mandatory to have a PAN card to file an ITR. In FY2017-18, about 67 million returns were filed, which is about 18% of total PAN allotted. Read more to know when one needs to file tax returns.

Having a PAN card doesn’t make ITR filing mandatory

-

Global Indian Solutions > News > Having a PAN card doesn’t make ITR filing mandatory

© 2021 GISER CONSULTANTS PRIVATE LIMITED | All Rights Reserved | Terms & Conditions | Privacy Policy | Designed by 1Solutions