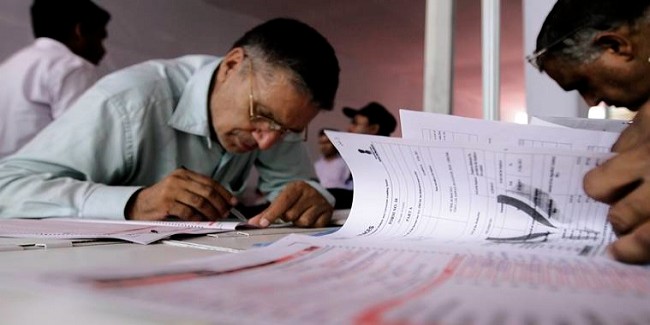

For those who became tax payers recently, the deadline for filing one’s returns is July 31 for the financial year 2017-18 – which ended on March 31. The financial year is succeeded by its Assessment Year (AY). For FY 2017-18, the AY is 2018-19. There are now clear penalties for being late in your return filing. If you miss the July 31 deadline, you have a penalty of Rs. 5000 levied on you.